Learn with Alium: Hybrid Liquidity Explained

- By Alium Finance

- 4m

- 22.07.2022

- 2

Since cryptocurrency trading and other DeFi features have increased in use, there has been an influx of new terms most of which people have no idea what they mean — words like liquidity, liquidity aggregators, liquidity pools, and now, hybrid liquidity aggregators.

For better understanding, we will be breaking down these concepts in detail, starting from the basics.

What is Liquidity?

Liquidity is a simple term used in a financial market as a measure of how quickly or easily a cryptocurrency or any asset can be converted to cash or other assets without difficulty or a significant impact on the market price. To further break it down, Forex is considered a liquid market considering the volume of daily transactions in comparison to real estate, or rare artifacts which are considered illiquid because they are not easily sold off or require a long process.

Now to cryptocurrency, stablecoins, Bitcoin and Ethereum have high trading volumes compared to most altcoins. This shows they can easily be traded without a significant impact on their prices. Liquidity is critical for all tradable assets, including cryptocurrencies, because it allows them to be traded quickly. Low liquidity levels indicate high market volatility, which can result in rapid price surges for cryptocurrencies. A high level of liquidity, on the other hand, indicates a stable market with low volatility in the price of the asset. With increasing cryptocurrency adoption and wide usage as a form of payment, there will be an increase in cryptocurrency liquidity.

Sounds too simple? Well… it’s actually that simple.

What is a Liquidity Aggregator?

A liquidity aggregator is a piece of software that enables users to access a pool of buy and sell orders from multiple liquidity providers/pools at the same time. Due to cryptocurrency market volatility, assets can be offered at different prices on different platforms.

The aim of aggregators is to allow crypto traders to buy or sell an asset at a price near the market average. For both the liquidity provider and the receiving counterparty, computer algorithms can be used to tailor the price streams to meet their needs.

What are Hybrid Liquidity Aggregators?

A Hybrid Liquidity Aggregator is exactly what it sounds like. In order to give traders the best possible pricing, a hybrid liquidity aggregator combines liquidity from both centralized and decentralized exchanges. With this, the trader will be able to place an order at the best possible price with little slippage.

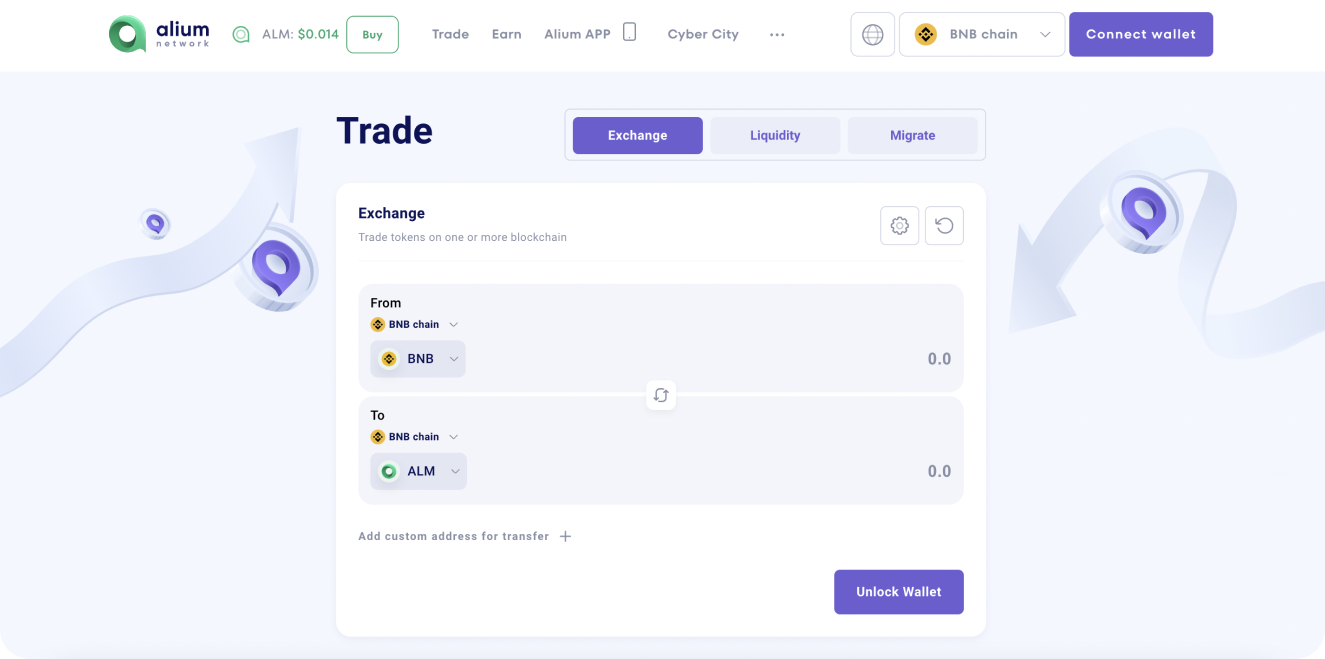

Hybrid Liquidity Feature by AliumSwap

Due to liquidity problems in the market, AliumSwap has created a Hybrid Liquidity feature as a solution for its decentralized AMM exchange with multi-chain options, and cross-chain features. Multi-chain DEX allows users to trade any cryptocurrency from one token to another within the same blockchain, or exchange their assets by using the cross-chain feature. To fully understand what I mean, current DEXs AMM (Automated Market Marker) offer their users unique advantages at the expense of enjoying maximum profits and benefits. Also, DEXs suffer severe setbacks due to a lack of interoperability in transferring assets and platform interaction. And this is when Hybrid Liquidity features come into action…

How Hybrid Liquidity works:

If the price impact on a chosen pair surpasses 5% or there’s no such liquidity pool on AliumSwap, the liquidity pool of the other exchange will be used.

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.youtube.com%2Fembed%2Fg-j7yzUYvZg%3Ffeature%3Doembed&display_name=YouTube&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3Dg-j7yzUYvZg&image=https%3A%2F%2Fi.ytimg.com%2Fvi%2Fg-j7yzUYvZg%2Fhqdefault.jpg&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=youtubeHybrid Liquidity Feature Release

Solving these challenges and more was the drive behind building a revolutionary project like AliumSwap.

Note: An automated market maker (AMM) is a decentralized exchange (DEX) technology that prices assets using a mathematical formula. In contrast to a traditional exchange, where assets are valued using an order book, assets are priced using a pricing algorithm.

Current Achievements of AliumSwap

Since its launch, there have been several significant progress and currently, the company’s Multi-chain DEX supports 10 blockchains, namely — Polygon, BnB Chain, Ethereum, HECO Chain, Fantom, Metis Andromeda, Moonriver, Moonbeam, Aurora, and OKC. Cross-chain feature together with the hybrid liquidity feature makes AliumSwap safe and secure from liquidity problems associated with DEXs.

Now that I have explained the basic terms surrounding liquidity, jump on our DEX and try it out.

Learn more about AliumSwap:

About Us: https://docs.alium.finance/

Official Website https://alium.finance/

Blog: https://blog.alium.finance/

Twitter: https://twitter.com/AliumSwap

LinkedIn: https://www.linkedin.com/company/alium-finance/

Telegram Chat: https://t.me/aliumswap_official

Alium Finance