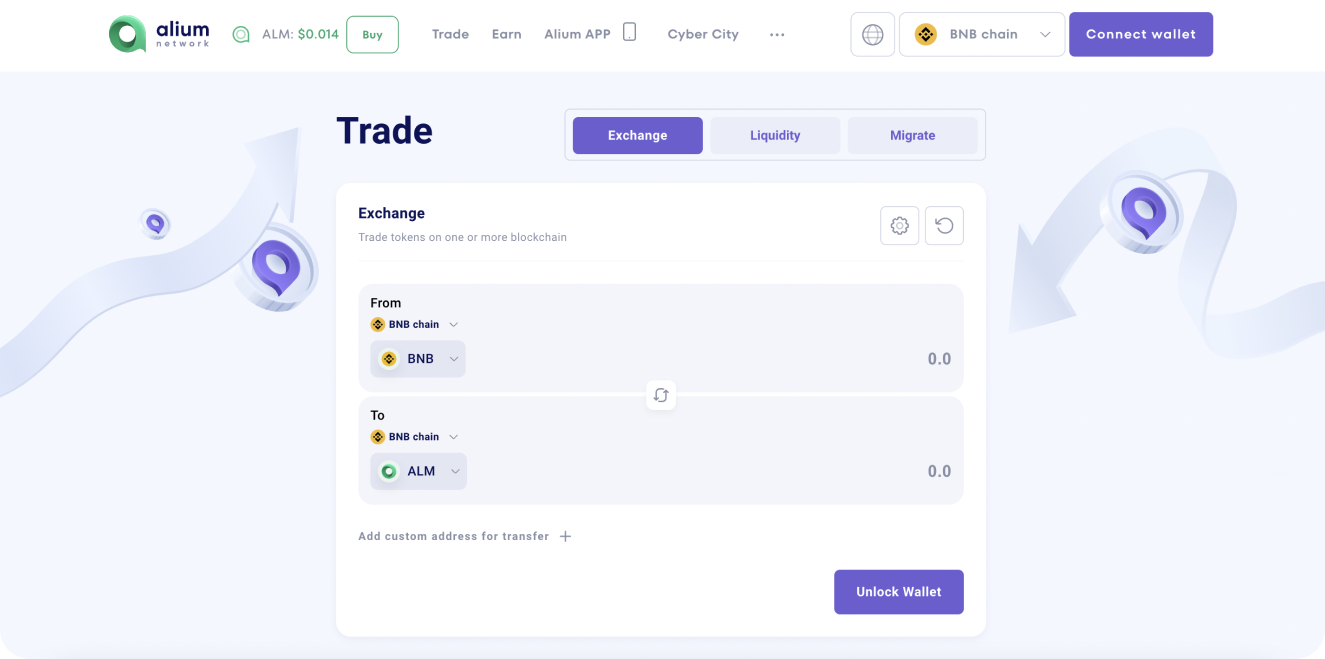

Alium is joining the trend of gamification and decentralized finance (DeFi) by integrating NFTs into its DeFi platform. NFTs have gained widespread popularity in recent years due to their unique ability to provide digital ownership and scarcity to digital assets. By incorporating NFTs into its platform, Alium aims to offer its users a unique gaming experience that combines the thrill of gaming with the opportunities for financial growth offered by DeFi.

In this article, we will discuss the main NFT usability features that Alium will implement and how they will provide users with an enhanced gaming and DeFi experience.

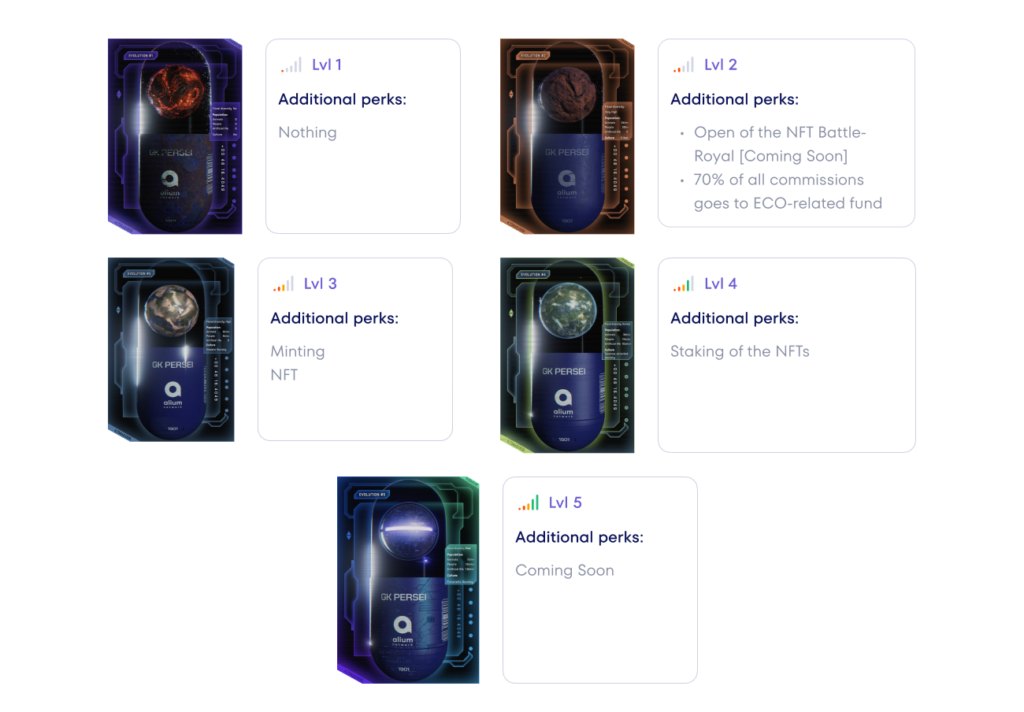

Even now at the NFT Holder Area users can see the current level of their NFT and the number of upgrades required to reach the next level. As users progress to higher levels, they will unlock new features such as participation in staking, Battle Royale, and other gamification features, which will be described below.

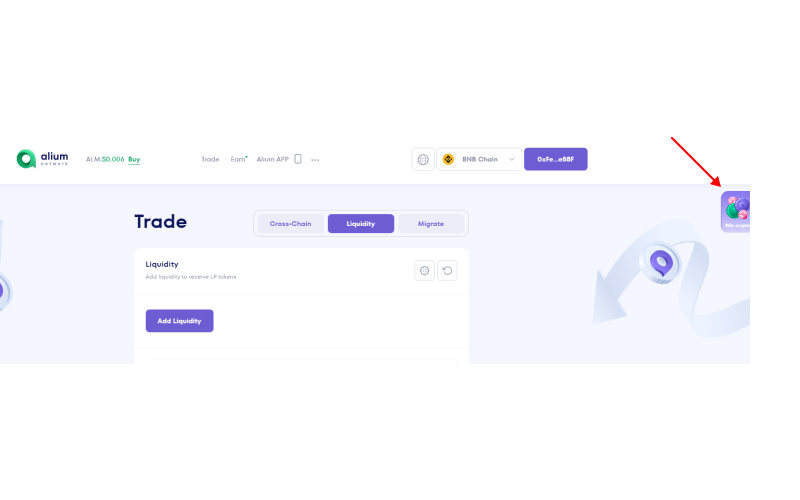

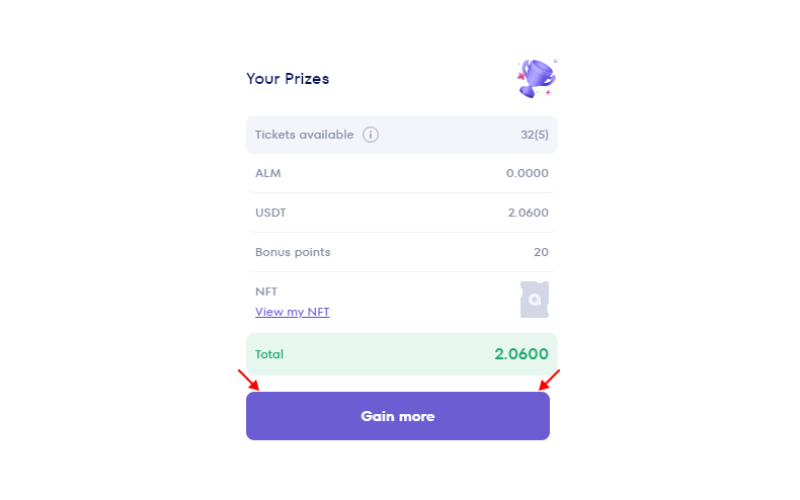

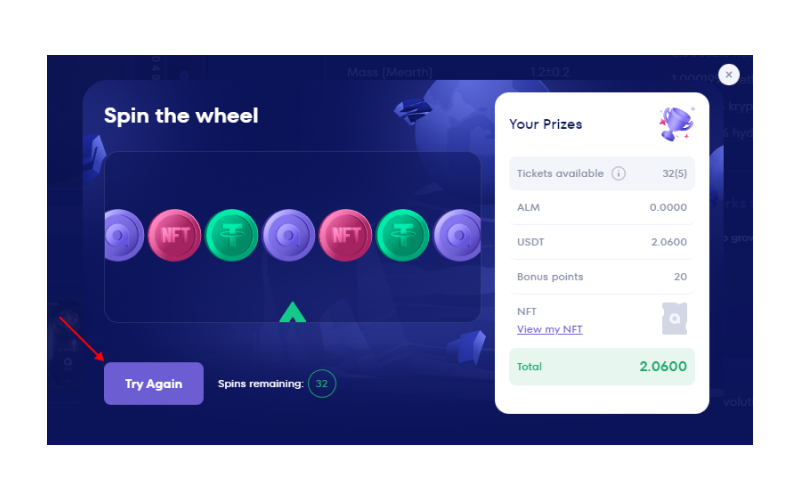

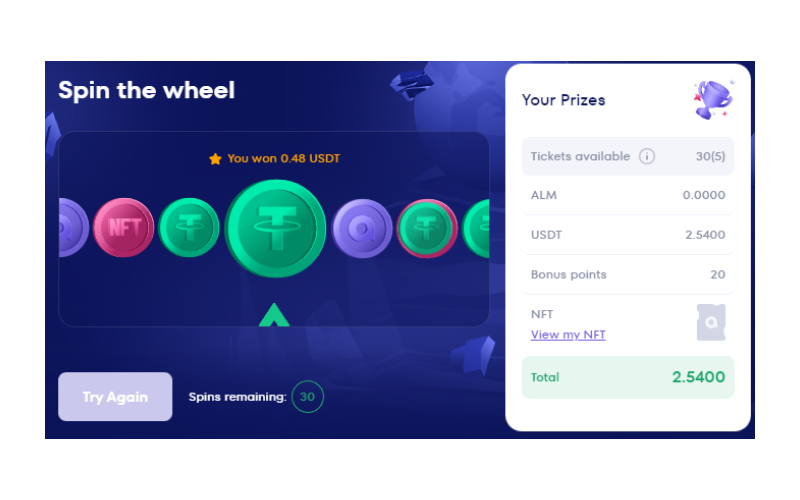

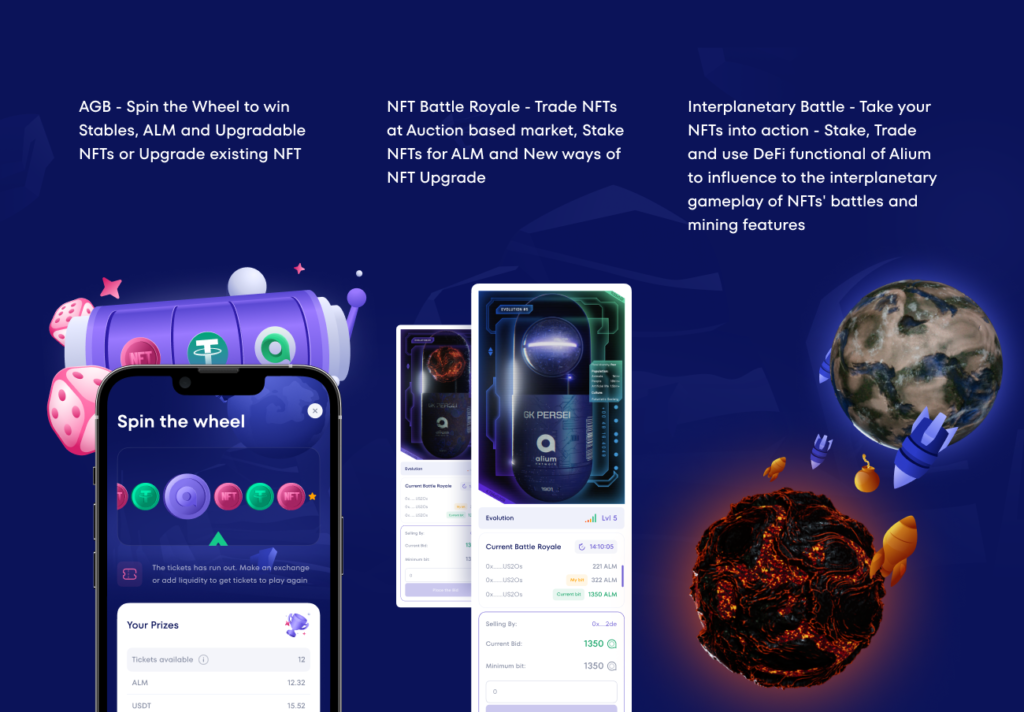

For now, users who participate in the first phase of gamification – Alium Green Button have the chance to win and upgrade NFTs – Planets. These NFTs are not just pictures but have real usability features. Great number of usability will be released at the second phase of gamification, when users will be able to sell and purchase the NFTs directly from other users at the Alium Battle Royale auction. This feature will provide an opportunity for users to trade NFTs and build their collections.

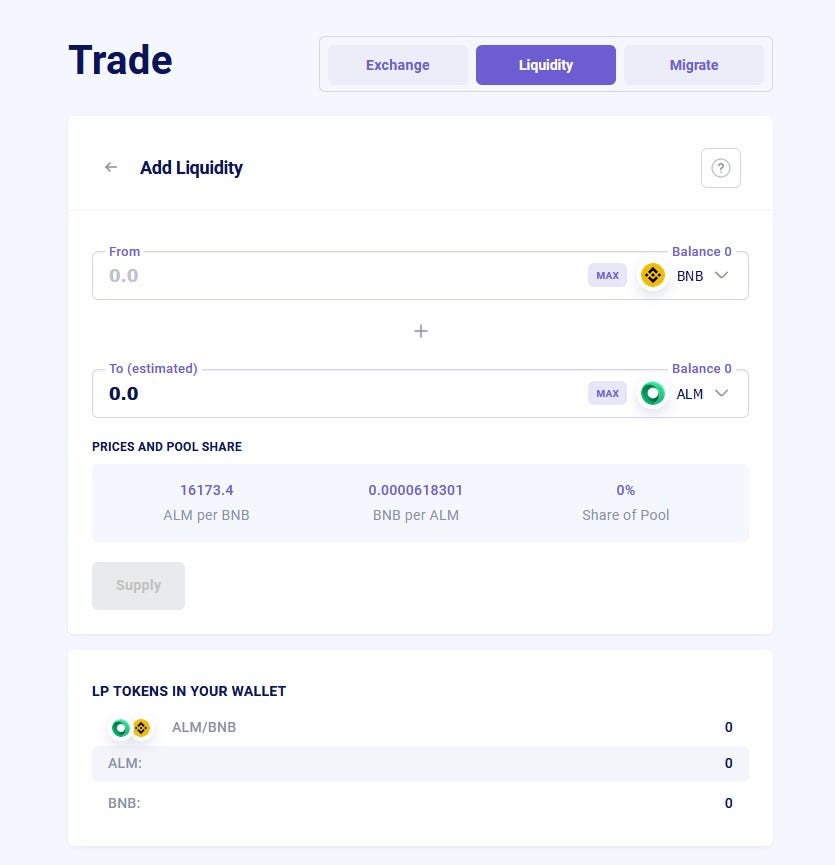

In the next quarter, Alium will introduce an NFT staking feature that will allow users to earn ALM tokens and other NFTs by staking their Planets. Staking options and pools will be closely connected, as users will extract resources from their Planets to earn rewards, but this will downgrade the evolution level of the Planet. In a real-world scenario, extracting resources from the planet will lead to environmental degradation, and users will have to invest in the Planet’s ecosystem to make it green and healthy again.

And finally, Alium will add a feature that will enable users to upgrade their NFTs using ALM tokens. This feature will give users the opportunity to increase the usability of their NFTs and unlock new features.

Currently, the NFTs available to win are Genesis Planets, with identical balanced configurations of available resources. However, with the second and third phases of gamification, Alium Green Button will introduce new Planets with different resource configurations that will influence the staking yield and future gamification features.

In conclusion, Alium’s NFT – Planets are a unifying feature across all phases of gamification, including the already launched Alium Green Button (AGB), as well as the upcoming phases planned to be released this year. These NFTs offer users a tangible and unique way to engage with the Alium platform and take part in its gamification features. The NFTs can be won through AGB or purchased through the Alium Battle Royale auction from other users. Additionally, users can stake their NFTs to earn ALM tokens and other NFTs, and even upgrade their NFTs using ALM tokens. As the Alium platform continues to expand and evolve with new planets, resource configurations, and gamification features, these NFTs will remain a key component in providing users with an interactive and engaging gaming experience that combines gamification and DeFi.